Financing Mexico: Powering North America’s Manufacturing & Logistics Hub

By Kristie Pellecchia Loiacono, Founder and Principal, Pellecchia International

How can companies get financing in Mexico? The first half of 2025 was marked by some sobering financial headlines. However, a look into the details shows growing hope for companies- notably from its northern neighbors the U.S. and Canada, looking to finance their activities in Mexico. At Pellecchia International, we help companies navigate complex financial and geopolitical situations to support their strategic goals.

On a global basis, financing needs could be abundant in the second half of 2025. Drivers of such demand include a backlog of mergers and acquisitions, the boom in data center development for growing artificial intelligence applications and cloud services, and a re-shifting of supply chains from Asia to the Americas. Nowhere are these factors more present than in Mexico. Thanks to its proximity to the United States, Mexico has a generational opportunity to become the premiere global manufacturing and logistics hub. The energy and transmission capacity to support Mexico is estimated to require approximately USD 67Bn in investment by 2030. While Mexico navigates a period of adjustment, strategic business growth and refinancing initiatives remain active drivers of capital demand. Finally, President Sheinbaum’s Plan México will require significant investment in infrastructure and other critical industries. Given the government’s growing fiscal deficit, ample support from the private sector will be necessary for the Plan México to be successful.

Emerging dynamics driving financing activity in Mexico

Investors are Patiently Waiting to Deploy Capital

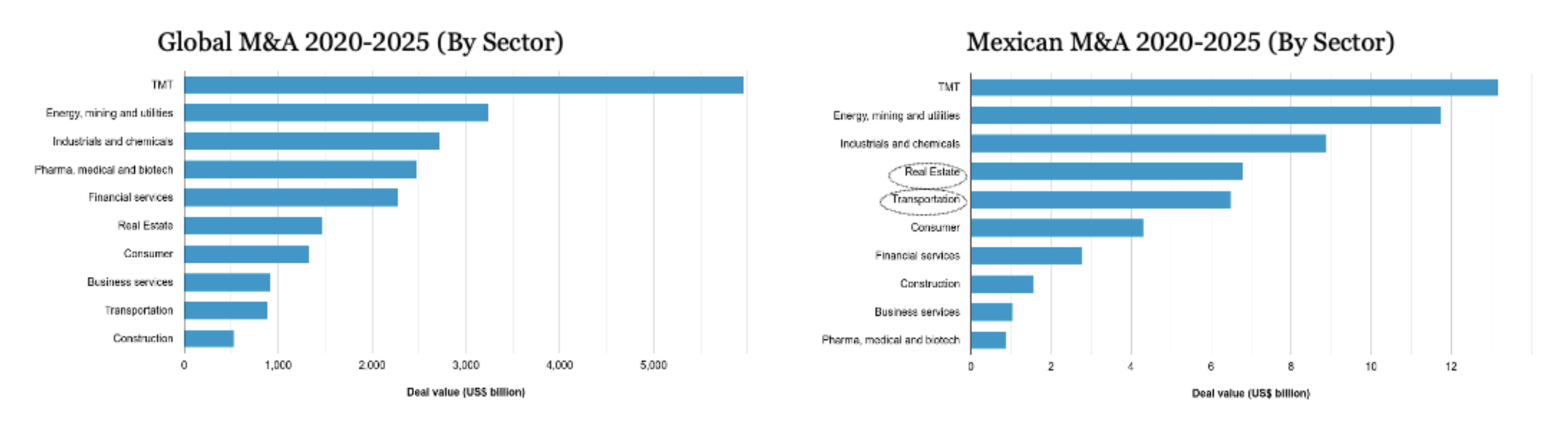

Investors around the world spent the first few months of 2025 analyzing the impacts of dynamic changes in geopolitical risks, persistently high interest rates, and tariffs to their portfolios. Private equity firms for example, typically large contributors to M&A activity, are estimated to be sitting on over USD3Tn in unsold investments as the IPO market has been essentially closed. On a global basis, while M&A activity was slow to take off in 2025 and the number of deals were down, a significant ramp up in activity took place in May and June of this year and deal volumes in 1H25 eventually exceeding deal volumes in 1H2024 by 26%.

In Mexico, 1H25 M&A volumes are down 17% over 1H24, a trend that began in 2023. In addition to the global economic environment of uncertainty, there are several other factors at play in Mexico. Mexico-specific uncertainty includes tariffs, judicial and regulatory reforms, USMCA

review, security, and energy & infrastructure availability. In addition, the first year of a Sexenio, or Mexican Presidential term, typically sees reduced deal activity. However, despite all this uncertainty there were 55 M&A deals in Mexico in 2025 in 1H25. If the status quo simply remains (and we have reasons to believe the pace could pick up), 2025 Mexican M&A activity could be on pace with 2024.

Issuers: Waiting for the Right Moment

Many Mexican companies are hoping to refinance or obtain new capital in a declining-rate environment. These Companies have prepared their materials and are simply waiting for the right moment to access the market. In response to tariffs specifically, we note that many Mexican issuers are evaluating how tariffs could affect their businesses before pulling the trigger on M&A or expansion plans. This mirrors the trend we are seeing in the US, with 30% of companies putting deals on hold or revisiting deals in response to tariffs.

Strategic Growth Continues to Drive Financing Activity

Megadeals over USD 10Bn hit a record high in 1H25, primarily associated with strategic investments in AI and technology. Minority investments have allowed investors to diversify their risks while still preserving capital for major strategic undertakings. In a survey of over 700 corporate and financial sponsors, 40% indicated that strategic growth will be the primary factor driving M&A activity in 2025. As companies reconsider global issues such as supply chain, Mexico could become a strategic cornerstone for some investors.

Investors are Paying More Attention to Latin America

Foreign investors are increasingly turning their attention to Mexico, recognizing its strategic location, macroeconomic stability, and growing role in nearshoring efforts. In 2025, interest in Mexican assets has risen as global capital seeks safer, more resilient markets closer to the United States. The Mexican peso has appreciated 13% YTD against the U.S. dollar, reflecting investor confidence and outperforming major equity indices in the U.S. This momentum presents a timely opportunity for capital deployment into Mexico’s expanding industrial and infrastructure base. While challenges remain, the overall outlook is one of cautious optimism as investors position themselves to participate in Mexico’s long-term growth story.

Attracting New Foreign Investors

The promise of nearshoring remains on the radar of many international investors, but the money has not yet followed. Foreign Direct Investment in Mexico was a record USD 36.9 Bn in 2024 (up 2% from USD 36.1Bn in 2023), while global FDI declined by 8%. Most investment was directed to the automotive, aerospace, telecom, financial services and electronics sectors, and took the form of a reinvestment of profits. Only 10% of FDI was directed to new investment. In fact, new FDI in Mexico declined 34% from 2023, and was at the lowest levels since 1993. Nearshoring continues to attract growing interest from international investors, with early capital flows signaling long-term potential. In 2024, Mexico received a record USD 36.9 billion in FDI—up 2% from 2023—despite an 8% global decline. Most investment focused on key sectors like automotive, aerospace, and electronics, mainly through reinvestment of profits. New FDI accounted for 10% of the total, suggesting significant room for future growth as confidence deepens.

Developing an Investment Climate in Southern Mexico

In addition to Mexico City and the State of Mexico, most of the FDI in Mexico continues to be concentrated in the northern states of Baja California, Nuevo León, and Chihuahua. The Plan México calls for aggressive expansion of infrastructure and technology development. Given the government’s deficit position and desire to reduce it, financing from the private sector is necessary for the plan to achieve its goals. To attract FDI, projects will need to be well-structured with the right frameworks that lay the foundation for private sector investment, including energy availability and security concerns which need to be addressed.

Navigate a New Judicial and Regulatory Framework

Government-imposed changes to energy contracts during the AMLO administration left many international investors in Mexico concerned. Current and proposed regulatory and legal changes may similarly give international investors pause as they compare the risk-reward equation against other jurisdictions that are easier to navigate. In addition to the new judicial reform, the abolition of regulators COFECE (the Federal Economic Competition Commission) and IFT (the telecommunications regulator), could hinder financing activity, as investors wait to see how the successor agency, Agencia Nacional para la Competencia y el Bienestar Económico, which falls under the Executive Branch, will take shape. The review of the USMCA in 2026 – likely followed by a renegotiation, and ongoing tariff negotiations could create additional deal inertia.

Despite these challenges, good deals are getting financed. Investors are tuned into several indicators that will create fertile ground for financial transactions in Mexico: nearshoring; the massive demand for energy that will require international know-how; and the sheer interdependence on the United States that should uplift Mexico’s economy.

How Deals are Getting Financed

Sources of Financing: Capital Markets

Equity: Overall, the performance of the local equity markets has held up in 2025. This can be attributed to several factors, including ongoing tariff negotiations, a weaker US dollar, and strong performance of exports and trade. The Mexbol index reached all-time highs during this period, hitting its highest interday ever on May 27, 2025. While most global real estate companies and funds have had a challenging few years in a high-interest rate environment, Mexican real estate has benefitted from a declining interest rate environment. As a result, fibras (the Mexican equivalent of US REITs) have led capital markets activity. In June, Xinfra, a Fibra focused on energy and infrastructure, opened the equity markets with the first fundraising for a Mexican company this year with a secondary issuance of MXN 5.14Bn (USD 274MM). Fibra Next raised MXN 8Bn (USD 436MM) on July 23rd, representing Mexico’s first IPO in 5 years. Fibra Educa, Arke, and Fiemex, have accessed or are planning to access the equity market this year. In addition, companies such as Aeromexico and the baseball team Los Diablos Rojos del Mexico, have made their plans to go to market known. We remain cautiously optimistic, noting the large backlog of activity that is being talked about privately among Mexican dealmakers, and expect that additional IPOs will further unlock activity.

Debt:

Relief in local interest rates, potential easing in US interest rates and a weak US dollar have led issuers to access the USD and MXP debt capital markets. We have seen a flurry of bond market activity not only in Mexico, but across Latin America. June of 2025 marked the busiest month in Latin American bond issuance on record, with the week of June 23rd marking its all-time busiest week. A significant amount of this issuance has come from sovereigns or blue-chip corporations as investors, while optimistic, focused on a flight to “quality” assets.

In January, the Mexican government tapped the bond market for the first of three issuances this year, raising a total of USD 15.88Bn equivalent in 2025, and announced additional plans in July to support Pemex to the tune of USD 10Bn. We have also seen several private companies make a comeback in the USD bond markets: America Movil, with its first USD issuance since 2022, Univision (the US Subsidiary of Televisa), and Fibra Next, which returned to the bond market after putting plans on hold in 2023. The Mexican retailer Elektra had announced plans to raise its largest ever (MXN 12.4Bn) issuance in a local bond to fund refinancings but recently put these plans on hold. Medica Sur announced plans to access the bond market after 5 years. We have also seen foreign companies, such as CMPC, issuing locally.

Other Sources of Liquidity and Nuanced Investor Appetite

Private Capital: Meanwhile, local investors are hungry for deal flow. Mexican banks remain liquid and quite active, having participated in a record number of loan transactions this year. Competition among domestic and international banks working in Mexico has even led to tighter borrowing costs for some borrowers. International banks, having received record revenues from trading activities in a volatile market, could have additional capital to put to work opportunistically in the form of loans. Afores are flush with capital after the 2020 pension reforms and, like many private equity firms, are sitting on cash and desperate for good investments.

Development Finance: Development financial institutions historically played a less prominent role in Mexico’s financing landscape then they do today, as Mexican energy and infrastructure has garnered significant interest from private international investors. During the AMLO administration, and specifically during the COVID pandemic, these institutions played a larger role and filled the void in private investment. Recently, the IFC announced it would fund up to $3Bn in financing planned for Mexico through July 2026, including environmentally focused investments in the form of blue bonds (an important theme in Mexico given its water challenges). This would be its largest 12-month deployment in the Country. Meanwhile, the US Government’s development bank, the DFC, has increased its Mexican portfolio from approximately USD 1.0Bn to USD 3.4Bn over the last 5 years. Mexican non-bank financial institutions and its fintech sector, which facilitate deeper financing penetration to small and medium businesses and the unbanked population, are favorable candidates for development capital beyond the more traditional drivers of economic growth, such as energy and infrastructure.

Charting a Path Forward

How can issuers take advantage of the various pockets of liquidity to manage growth during this time of economic uncertainty? The following are some key issues to consider:

Maintain a clear strategy and a strong investment case for the use of proceeds and be able to explain how one will navigate the nuances of Mexican business. Competition is fierce; garnering attention from investors requires a compelling business case. Consider the benefits of strategic versus financial investors and their different motivations. It is worth reemphasizing that strategic investments remain a key driver behind financing activity. Keep in mind that certain sectors have greater access to capital (see below for M&A and above for FDI). Companies outside these sectors may need additional support to identify investors and explain the value proposition. Demonstrated local expertise is crucial.

Identify appropriate formation vehicles and structures that may be available for specific projects, entire companies, or specific investments. Specific structures (such as Fibras for companies, or creative structures for funds), can help increase investor appeal when properly matched with the investor’s particular demands and concerns.

Create the appropriate protections to minimize the impact of uncertainty. For example, Tariff Reserve Accounts can comfort investors that potential cost overruns due to tariffs will be limited. International arbitration can also be a powerful mechanism to offset backsliding into Mexico’s legal and regulatory framework.

Sovereign and sub-sovereigns must develop project frameworks that will attract private sector investors. Well-structured public-private partnerships, concessions, and other investment schemes that include the right deal protections, are fundamental to attract private sector investment in scale.

Consider the geopolitical aspects of the project. In a time of tensions, geopolitical advantages could attract non-traditional financing or strategic partners. Investment outreach plans should consider these options.

Increase the investor universe by tapping into sustainable structures if applicable for the project. The availability of green bonds, blue bonds, and sustainable loan and bond structures for corporates and projects are creating depth to the financing market and have been gaining popularity in Latin America. Issuers must consider the benefits against administrative costs and a longer execution timeline.

Prepare for headwinds and manage issues early on. Recession, changing regulations, and potential tariffs can create shocks to businesses. Mexican issuers should always develop a sound and flexible capital structure with sufficient cushion to provide the best chance of managing unforeseen disruptions. Hiring advisors early on to address issues proactively with creditors and other stakeholders can help avoid costly restructurings.

For M&A transactions, consider minority or preferred equity sales where possible, versus an outright sale, to generate liquidity. Buyers that have been reluctant to pay full value in a high multiples environment have been increasingly willing to take on non-controlling positions.

As Mexico cements its role as a strategic manufacturing and logistics hub for North America, financing remains both essential and complex. Deals are getting done—but they require patience, strategic planning, and a deep understanding of the landscape. In this evolving environment, companies must equip themselves with the right advisors and trusted allies to navigate the nuances, unlock capital, and turn opportunity into sustained growth.

References

1 Morgan Stanley Research

2 https://kwsn.com/2025/05/22/mexico-inflation-rises-past-central-bank-target-in-early-may/

3 https://english.elpais.com/international/2025-01-27/plan-mexico-sheinbaums-strategy-to-attract- investment-amid-uncertainty-over-trump.html

4 https://www.ft.com/content/62b1db7b-3e78-47ca-865e-02cc404915f0

5 Mergermarket, Pitchbook data (January 1, 2025-July 2, 2025)

6 Mergermarket, 1H2025 data

7 Mergermarket, 1H2025 data

8 Pitchbook Data, January 1-July 2, 2025

9 PWC Pulse Survey, 2025

10 Global M&A Outlook: https://www.goldmansachs.com/what-we-do/investment- banking/insights/articles/global-ma-in-2h-2025/goldman-sachs-ma-outlook-2h-2025.pdf

11 Latin Finance: LatAm Investment: A New Order, July 8, 2025

12 MXP:USD exchange rate, January 1-June 17, 2025, Xe.com

13 United States Department of State, 2024 Investment Climate Statements: Mexico

14 https://www.bloomberg.com/news/articles/2025-07-24/mexico-s-annual-inflation-slows-opening-space- for-new-rate-cut

15 https://chambers.com/articles/reform-to-the-mexican-federal-economic-competition-law- creation-of-the-new-national-antitrust-commi

16 Pitchbook Data, January 1, 2025, to July 2, 2025

17https://www.nasdaq.com/articles/mexicos-equity-market-hits-all-time-peak-us-tari_-risks-ease